Bitcoin and Ethereum remain the most recognized and influential cryptocurrencies in the market. Bitcoin, often referred to as digital gold, serves as a store of value and a hedge against traditional financial fluctuations. Its scarcity and widespread recognition make it a popular choice among long-term investors. Ethereum distinguishes itself by enabling smart contracts and decentralized applications, powering sectors like decentralized finance (DeFi) and non-fungible tokens (NFTs). Understanding the real-world applications of these digital assets can help investors decide which cryptocurrencies align with their financial goals and risk tolerance.

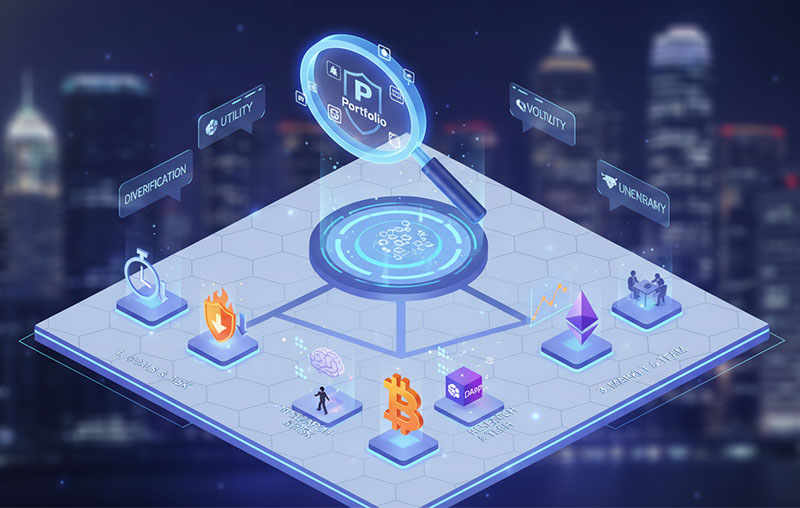

Factors to Consider Before Investing

Selecting the right copyright goes beyond just popularity or current price. Investors should evaluate factors such as market capitalization, liquidity, technology, and community support. Market capitalization provides insight into a coin’s stability and growth potential. High-market-cap coins like Bitcoin and Ethereum generally offer more stability, whereas smaller-cap cryptocurrencies may have higher growth potential but come with significant volatility.

Liquidity is another crucial element, as it affects how easily an asset can be traded without drastically impacting its price. Cryptocurrencies with high liquidity are more suitable for active trading, while long-term investors may prioritize technological innovation and adoption over immediate liquidity. Examining the development team, project roadmap, and user community can also indicate a coin’s likelihood of long-term success.

Regulatory environment is an additional factor to consider. Cryptocurrencies operate in a constantly evolving legal landscape, and changes in regulation can significantly influence market behavior. Staying informed about global regulatory updates is vital for minimizing investment risks and making informed decisions.

Popular Cryptocurrencies Worth Considering

When considering what's the best copyright to buy established coins like Bitcoin and Ethereum are frequently highlighted. Bitcoin is renowned for its security, liquidity, and long-term growth potential, making it a cornerstone for many investors. Ethereum offers utility beyond simple transactions, enabling the development of smart contracts, DeFi platforms, and various blockchain-based applications, enhancing its appeal to both investors and developers.

Other notable cryptocurrencies attracting attention include copyright Coin, Cardano, Solana, Polkadot, and Avalanche. copyright Coin benefits from its integration with the copyright exchange, providing both utility and adoption within the copyright ecosystem. Cardano emphasizes a research-driven, scalable approach to smart contracts, appealing to developers seeking sustainable blockchain solutions. Solana has gained popularity for its high-speed network capable of processing thousands of transactions per second, making it ideal for decentralized apps and financial services. Polkadot and Avalanche are notable for interoperability and scalability, allowing multiple blockchains to communicate effectively and expanding the possibilities for developers and users.

Emerging altcoins, while riskier, can offer significant upside potential. Cryptocurrencies like Chainlink, Polygon, and VeChain have demonstrated strong use cases, partnerships, and technological innovation. However, investing in smaller or newer tokens requires careful analysis, as market volatility can be extreme, and not all projects succeed long-term.

Effective Investment Strategies

Investing in cryptocurrencies requires a careful, strategic approach. Diversification is critical, as spreading investments across multiple digital assets can help mitigate risk. Long-term holding, often referred to as "HODLing," allows investors to withstand short-term market volatility while capitalizing on potential growth over time.

Staying updated on market trends, technological updates, and regulatory developments is essential for making informed decisions. copyright markets are highly responsive to global economic shifts, technological upgrades, and investor sentiment. Conducting thorough technical and fundamental analysis can provide insights into potential price movements and help guide investment choices.

Security is a major concern for copyright investors. Using secure digital wallets, hardware storage devices, and reputable exchanges helps protect assets from hacking and theft. Understanding best practices for private key management and digital security is essential, especially as decentralized finance platforms and non-custodial wallets become more prevalent.

Conclusion: Choosing the Right copyright

Deciding what's the best copyright to buy requires balancing potential rewards with risk management. Established cryptocurrencies like Bitcoin and Ethereum offer stability, liquidity, and proven adoption, while newer altcoins may present opportunities for higher returns but come with increased volatility.

Successful copyright investing relies on research, strategy, and discipline. By understanding market trends, technology, and regulatory factors, investors can make informed choices that align with their financial objectives. Whether seeking long-term growth, active trading opportunities, or portfolio diversification, a thoughtful approach to copyright investment can maximize potential returns while minimizing risk in this dynamic and rapidly evolving market.